Main Ideas of Diamond-Dybvig

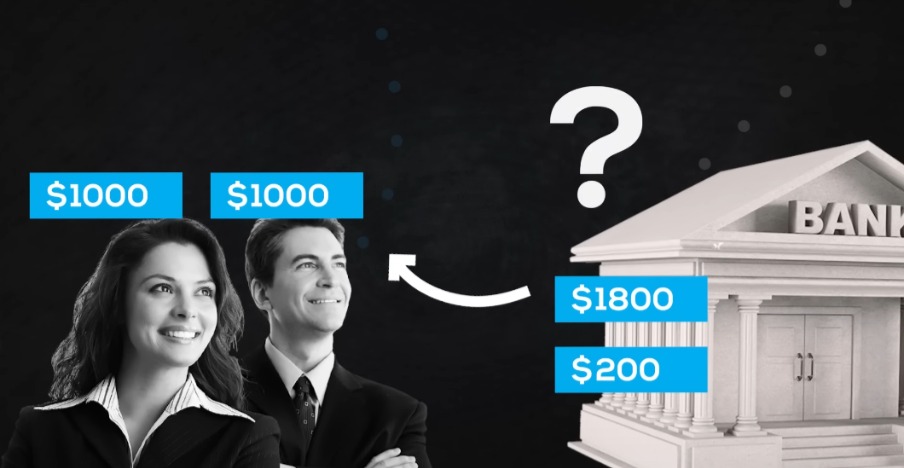

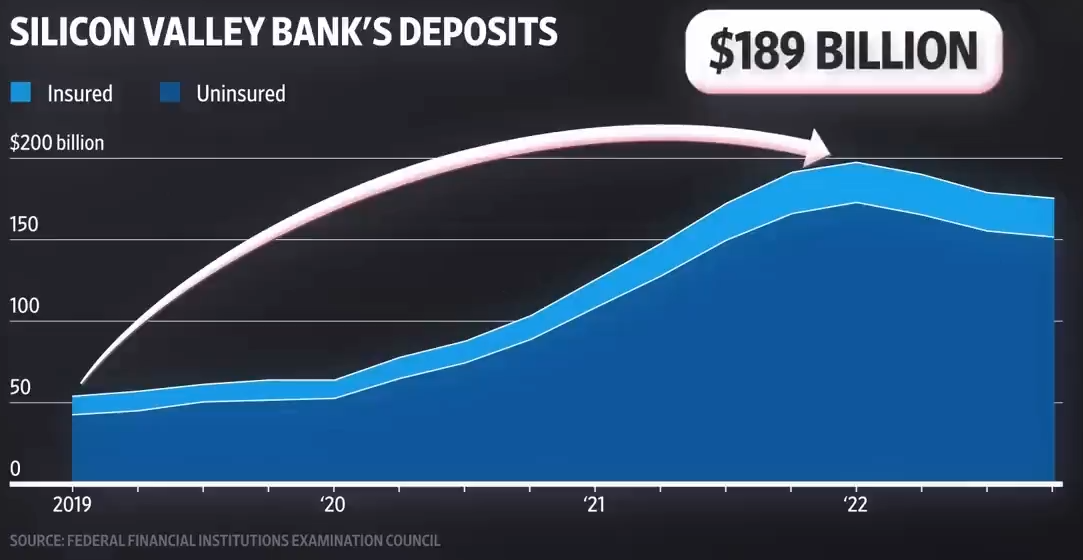

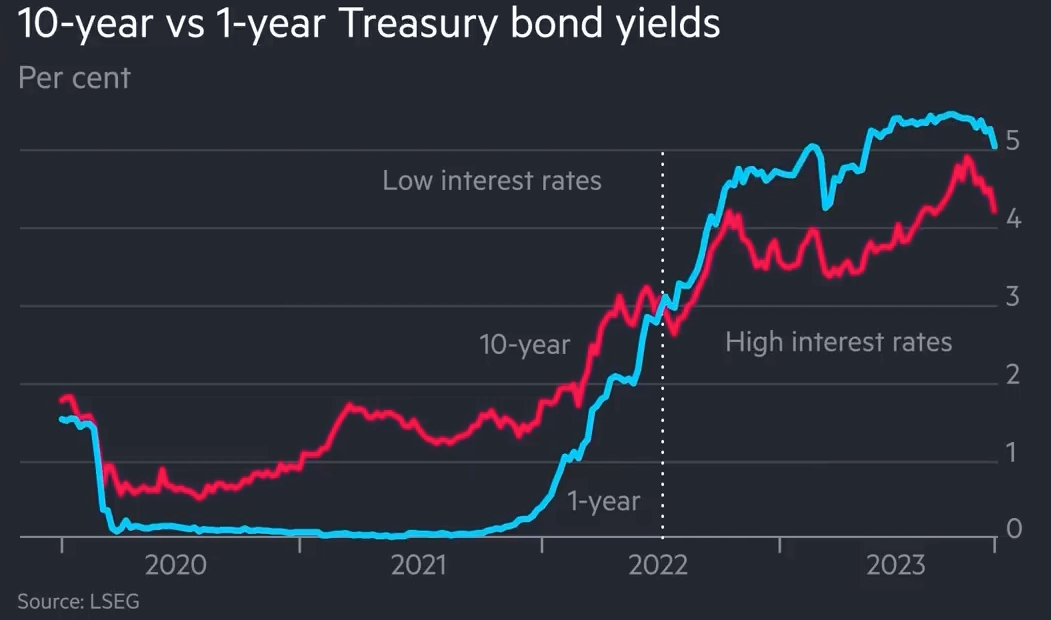

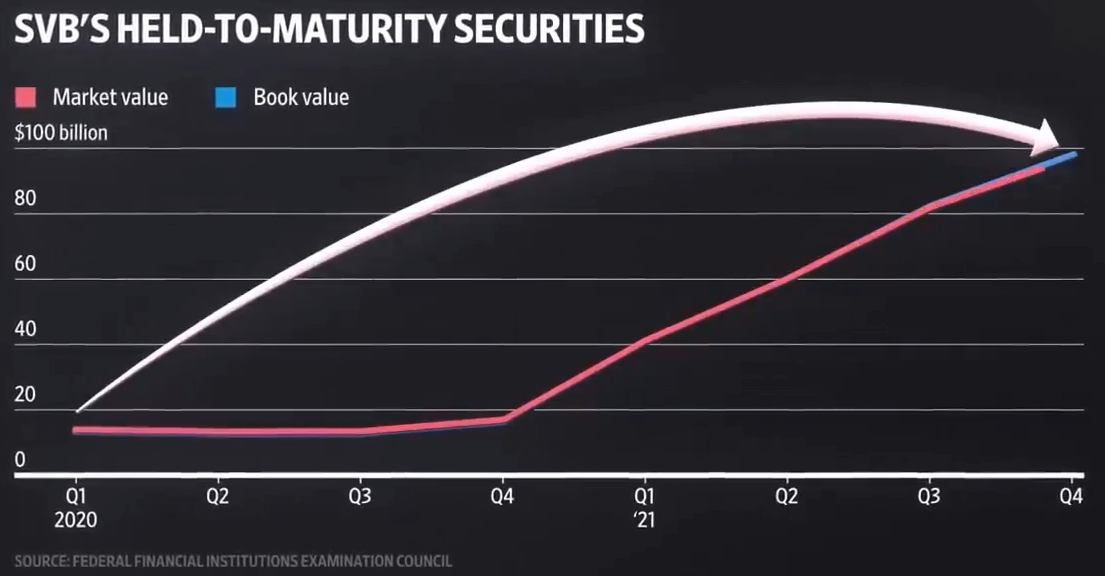

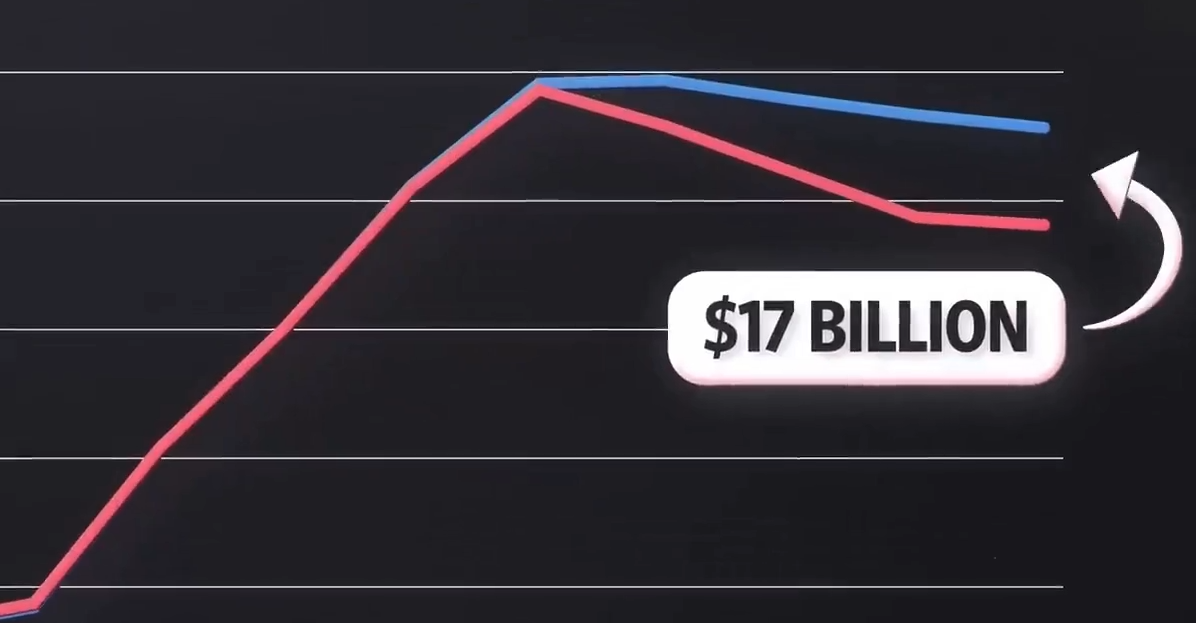

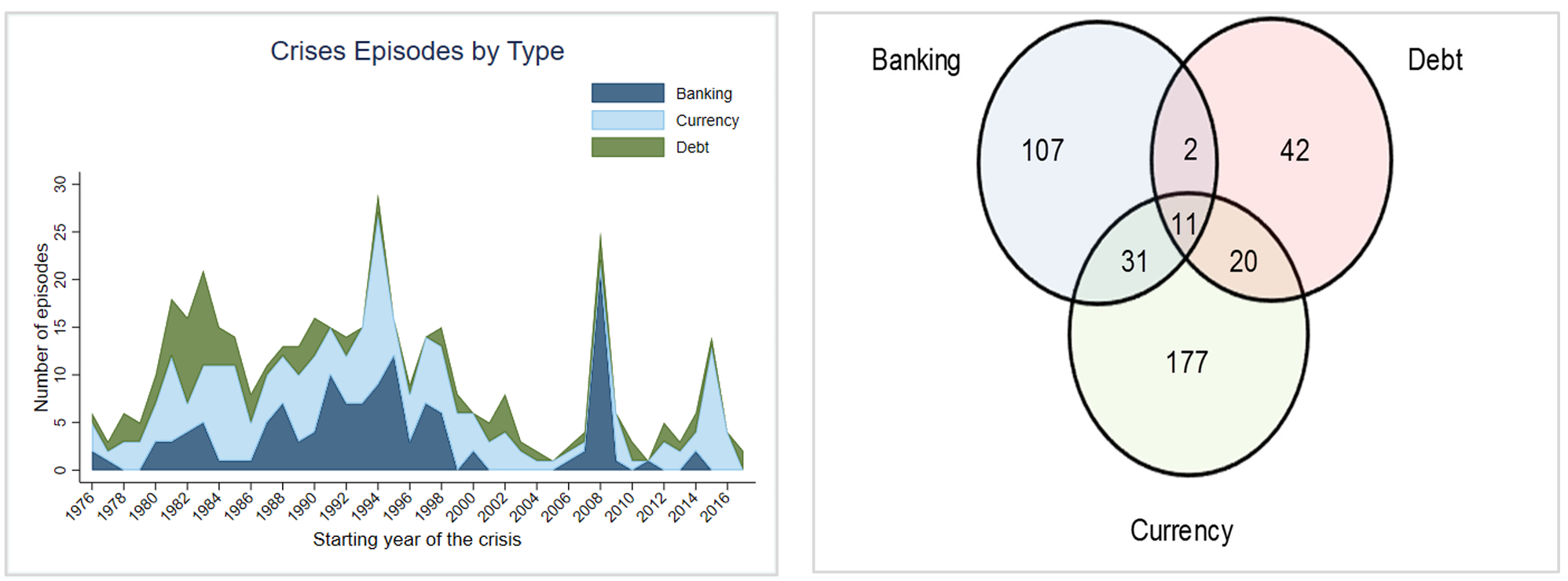

Liquidity Transformation: Banks transform liquid deposits into illiquid loans, providing liquidity to depositors who may need their funds back on short notice while investing in longer-term projects that cannot be quickly liquidated without loss.

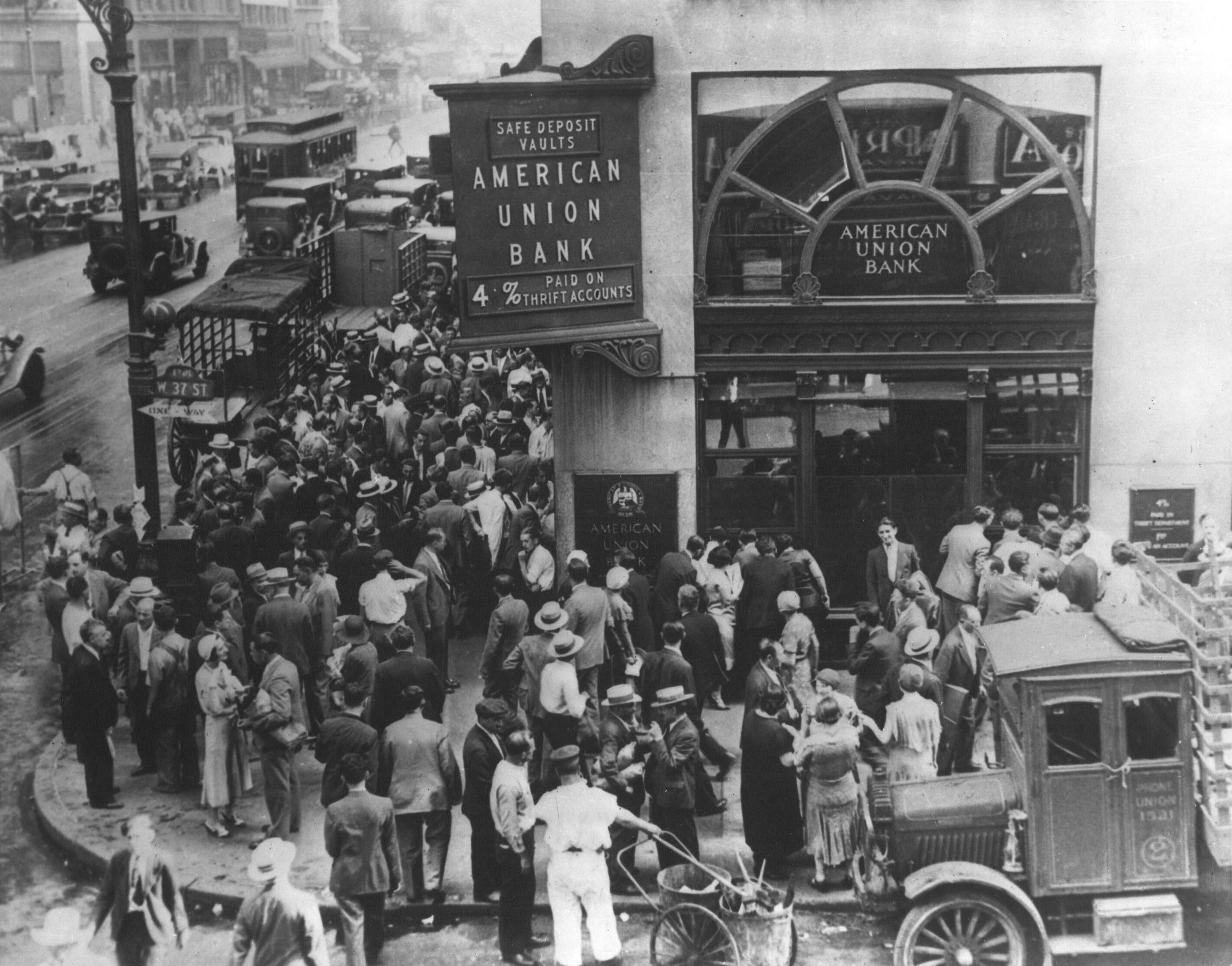

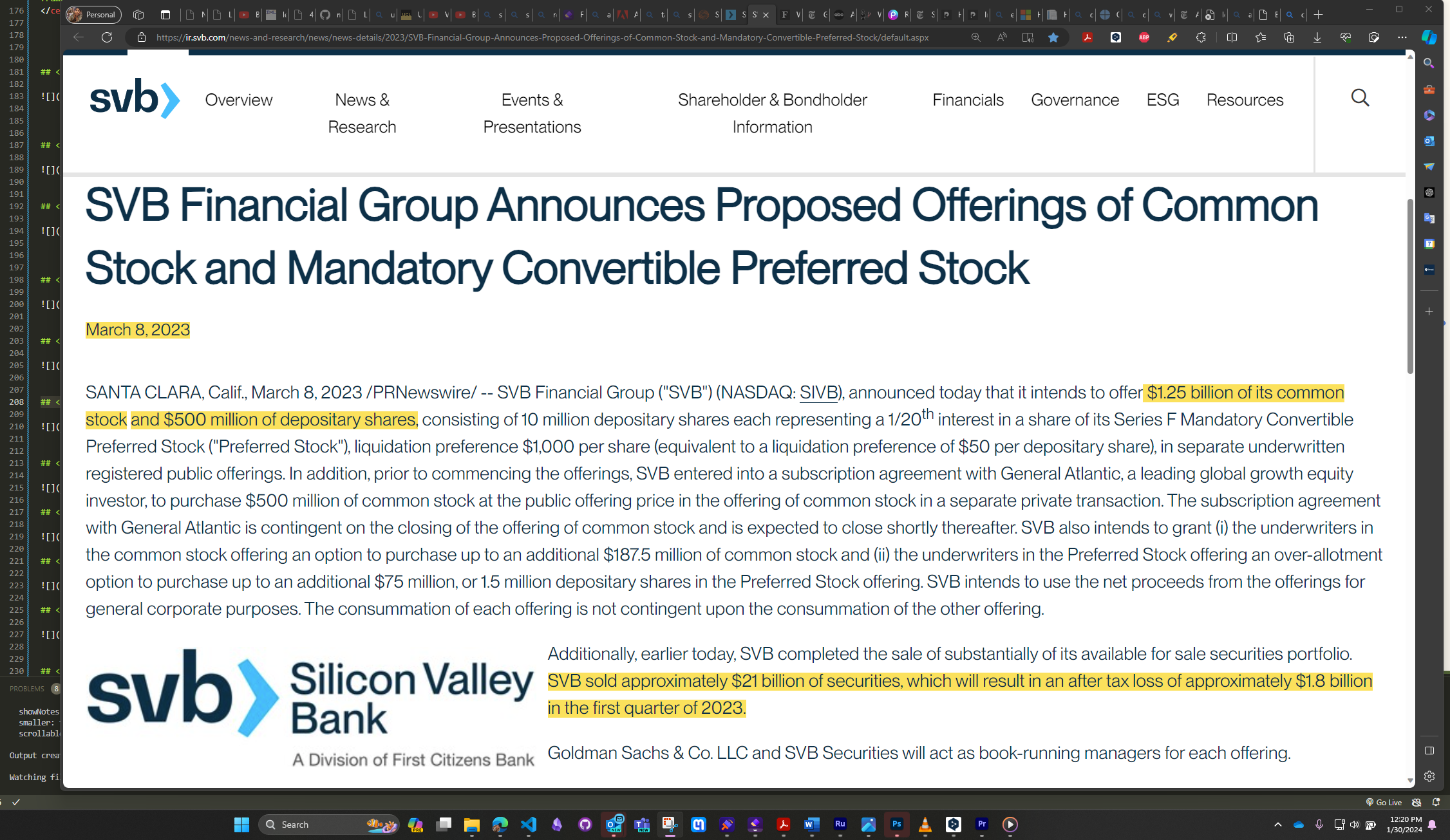

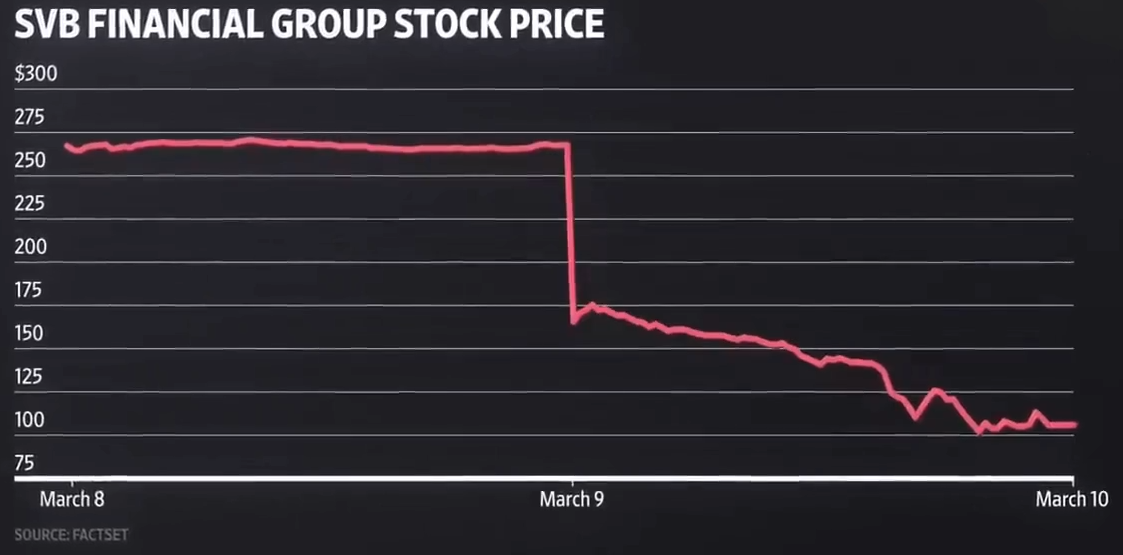

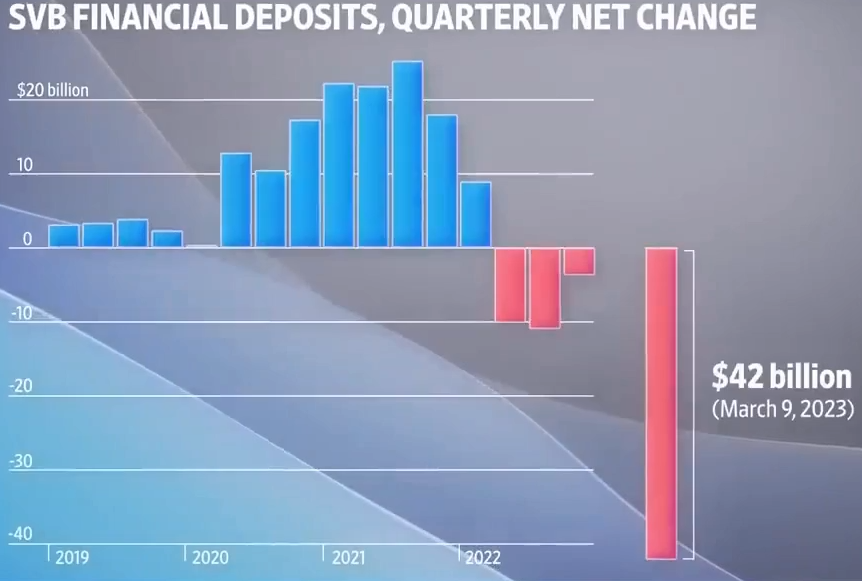

Sequential Service Constraint: The model assumes that banks operate on a first-come, first-served basis. This creates a situation where, if all depositors try to withdraw their funds simultaneously (fearing that the bank will run out of liquid assets), the bank will indeed run out of cash, leading to a self-fulfilling prophecy.

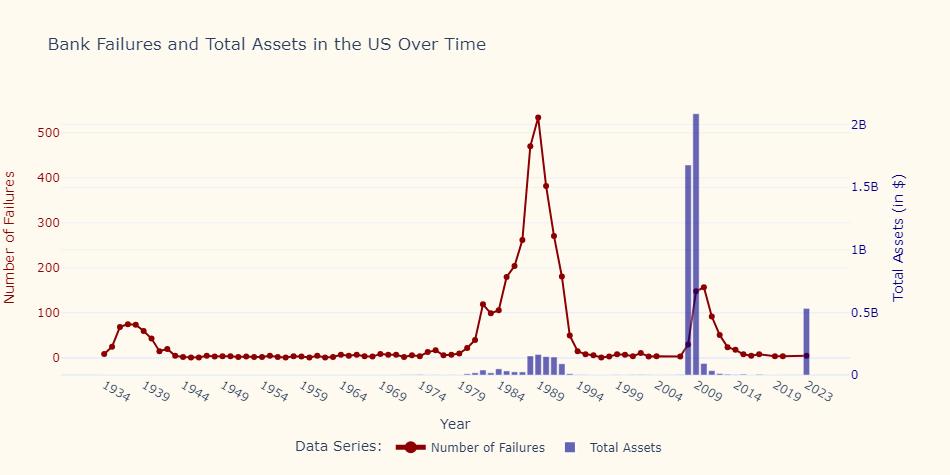

Multiple Equilibria: One of the critical insights from the model is the existence of multiple equilibria: one where everyone trusts the bank and does not rush to withdraw (a stable equilibrium), and another where a panic leads to a bank run (an unstable equilibrium).

Role of Expectations: The possibility of a bank run is driven largely by depositors’ expectations. If depositors expect others to withdraw their money, they have an incentive to withdraw theirs as well, leading to a bank run